Financial Advisory

Financial Advisory Services at Sicol-Global

Financial advisory services

1. Transaction Services

We help businesses in mergers, acquisitions, and divestments with strategic guidance, appraisals, and due diligence.

• Stat Insight: Companies using an M&A strategy enjoy a 10-15% increase in shareholder return (Harvard Business Review).

2. Corporate Finance

Our professionals provide your business with custom solutions of capital structure, financing approaches, IPOs, as well as market analysis so that your firm will be ready to face financial challenges head-on.

• Stat Insight: Companies with a focus on corporate finance and capital management experience growth at 18% more than those with no strategy (McKinsey).

3. Crisis & Recovery

We work with distressed businesses, creating debt management, restructuring, and turnaround plans to revive their financial health.

• Stat Insight: 70% of businesses say that they have financial stability when they implement crisis management strategies (Deloitte).

4. Risk Management

As the market becomes unpredictable, we protect your business against risks by offering mitigation: cybersecurity, governance, internal audits, and so much more.

• Stat Insight: 62% of financial companies fail to detect new risks before such risks arise causing revenue losses (PwC).

5. Accounting Advisory

Our advisory service enhances financial performance for better reporting and compliance: long-term financial stability as well and growth.

• Stat Insight: Companies with effective accounting advisory practices have 25% higher long-term profitability (Bain & Company).

6. Tax Advisory

Achieve maximum tax efficiency through our tax strategy, compliance, and optimisation advice.

• Stat Insight: 88% of business owners claim to have seen better tax savings and compliance after engaging with tax advisors (KPMG).

7. Real Estate Advisory

We provide market insights, valuations, and risk assessments for the best real estate investment decisions.

• Stat Insight: 55% of businesses enhance their ROI through collaboration with experienced real estate consultants (CBRE).

8. Forensics & Litigation

Our forensics services help businesses detect fraud, resolve disputes, and go to court, providing fully integrated, data-driven intelligence.

• Stat Insight: Organisations that apply forensic consulting services reduce the average cost of litigation by 15% (ACFE).

The real estate advisory segment supports clients with financial matters in the area of real estate and property management. Key offerings include location advisory, real estate valuations, transaction support on property deals, and optimising real estate asset portfolios (often in combination with financial asset management). Clients typically span four stakeholders types: governments and local municipalities (i.e. area development), housing corporations (i.e. strategic supply management, risk management), companies (portfolio management, location support) and real estate investors (i.e. due diligence, portfolio analyses).

The forensics & litigation segment supports clients with a range of services that follow from actual or anticipated disputes or litigation cases. Propositions include dispute advisory, forensic accounting services (which combines accounting, auditing and investigative skills), litigation support and electronic discovery (or e-discovery). Work can range across industries and topics – a forensic consultant (also known as an auditor or investigative auditor) can deliver economic damages calculations for governments, antitrust bodies or companies, support tax fraud or money laundering investigations or look into digital crimes such as cyber-attacks or data theft.

Why Choose Sicol-Global Financial Advisory?

• Expertise: Years of proven results across industries.

• Tailored Solutions: Customised strategies for unique business needs.

• Proven Results: Trusted by leading financial companies to enhance performance and achieve financial goals.

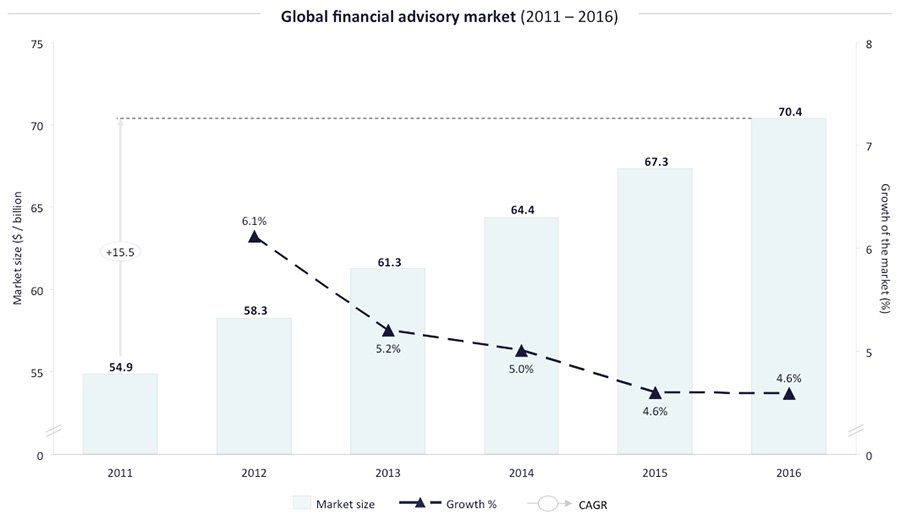

Stats: The global financial advisory market size is $67 billion and growing steadily, driven by demand for M&A, risk management, and crisis recovery services. Stay ahead in the competitive market with our expertise.

Ready to make informed financial decisions? Contact Sicol-Global Financial Advisory today and secure a successful future for your business, backed by solid financials statements and comprehensive insights.